Financial freedom after military service

For many military veterans, the battles don’t stop upon returning home. From physical and mental health challenges to housing and food security, there are a number of issues that can plague service members as they transition back into civilian life.

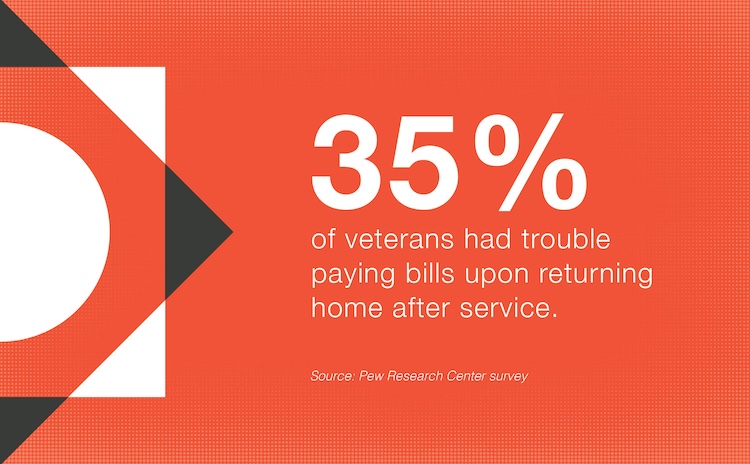

According to a Pew Research Center survey, 35 percent of veterans had trouble paying bills upon returning home after service. Furthermore, around 25 percent of veteran families reported having less than $500 in emergency savings, a survey by the Military Family Advisory Network found in 2023.

Amid all these challenges, staying out of debt and managing everyday finances can be particularly challenging for veterans. Fortunately, there are resources available. If you or a loved one is a veteran, here are some federal programs to keep in mind:

- VA home loans: the U.S. Department of Veterans Affairs (VA) has a home loan program available to veterans and surviving spouses. The key benefits of these loans include no down payment required, low interest rates and closing costs, and no need to take our private mortgage insurance. By utilizing this program, you can more easily buy, build, repair, or remain in your home.

- VA health care: seeing a doctor and paying for prescriptions can be among many Americans' highest expenses. Through the VA, veterans are covered for regular checkups and visits with specialists in addition to affordable access to medical equipment and prescription medications.

- Military debt consolidation: known as a VA Consolidation Loan, if you have a VA loan on your home this refinance option is available to you. This loan allows you to refinance your home loan for more than the amount you owe while keeping the difference in cash. This loan is guaranteed by the VA and typically offers lower interest rates compared to what’s available to non-veterans.

- Student debt relief: while you may have benefited from the GI Bill when you were an active military service member, you might still have student loans to pay off. Through the Public Service Loan Forgiveness (PSLF) program, federal student loan borrowers can have their balance forgiven after ten years of employment at an eligible non-profit or government agency. If you remained employed by any branch of the armed services or the VA, you are likely eligible for relief through this program. Other programs like the National Defense Student Loan Discharge exist for service members who were in a hostile-fire location. Further, if you were totally and permanently disabled during your service you can qualify for full loan relief.

Managing debt is a top priority for many veterans. If you’re looking for tools and resources to help you on your personal financial journey, Westfield Bank is here to partner with you. Get in touch with our team today to see how we can help.