What does consolidation mean for your insurance agency?

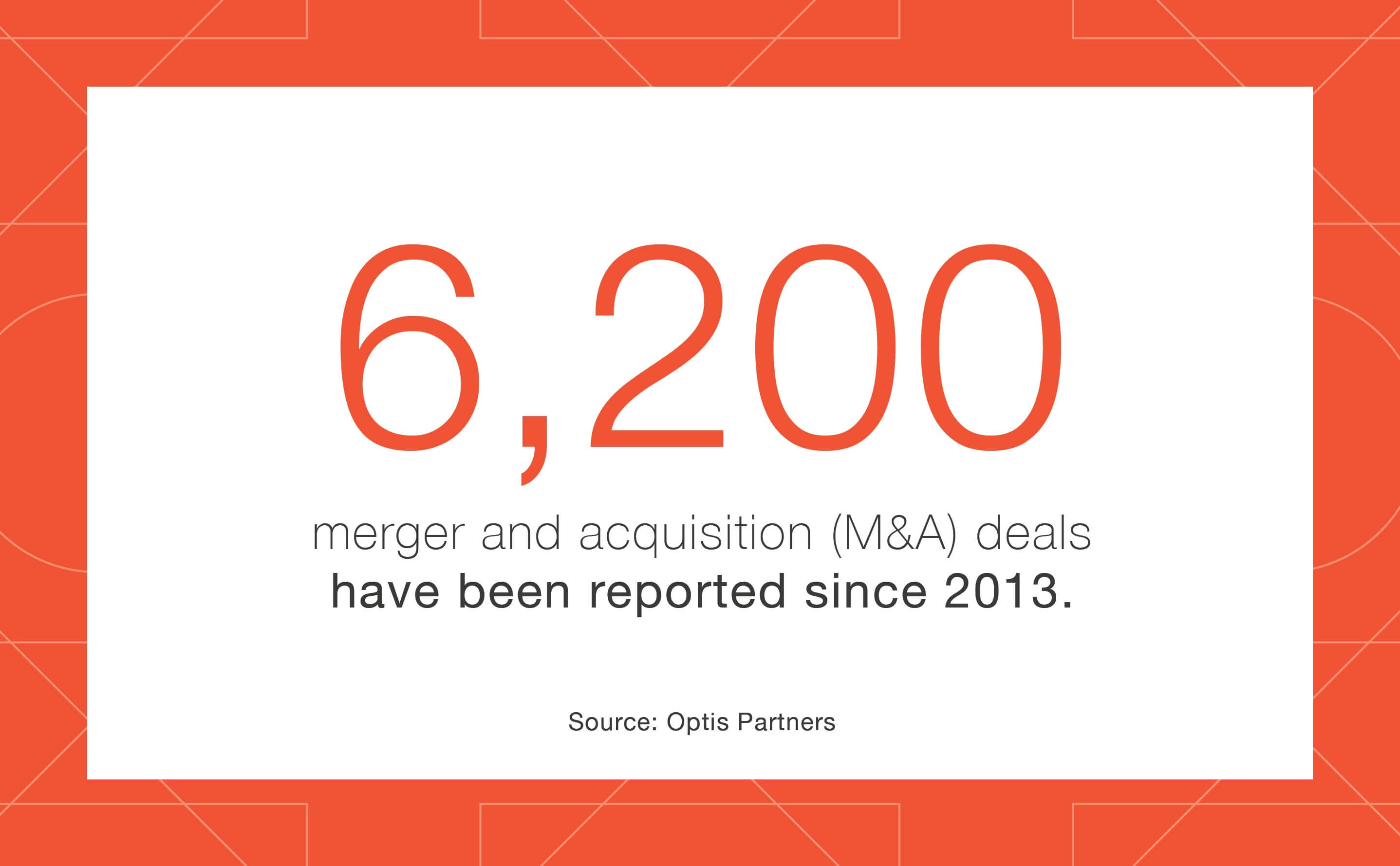

In recent years, it’s been hard to ignore the rise of consolidation in the insurance industry. Since 2013, more than 6,200 merger and acquisition (M&A) deals have been reported, according to Optis Partners, which is a 250% increase. Though that same database found that 2024 saw a slight slowdown in this trend, with 750 M&A deals compared to 833 in 2023.

Whether or not your agency has been involved in a recent M&A deal, the consolidation trend has likely impacted your agency in some fashion. Given today’s market realities, there are a few lessons independent insurance agency owners need to know in this era of consolidation.

Know your value

Valuations have always been important, but even more so today. The consolidation trend and the resulting influx of private equity funds in the industry has yielded great valuations for many independent agency owners. While every owner is in a different position, there’s a good chance your agency’s value has gone up significantly over the last decade. Keep in mind, while all agencies aren’t targets for private equity buyers, it is likely your agency has appreciated in value overtime. Even if you’re not anticipating making any deals in the near future, now is probably a good time to determine the value of your agency.

Plan for transition

No matter what stage of the business lifecycle you’re in, the current M&A environment makes it imperative that you have a transition plan in place. You never know when a deal you can’t turn down will present itself, and the last thing you want is to be caught flat-footed when an opportunity arises. Get together with your team and any trusted advisers to craft a written transition plan that aligns with your long-term business goals, and make sure to revisit this plan when market factors change.

Embrace your independence

As consolidation takes hold, the industry risks losing out on the unique offerings of smaller, independent agencies. As it was described in the Insurance Journal magazine, the consolidation trend has resulted in “smaller firms struggling to compete, medium-sized firms thriving due to niche expertise, and colossal entities dominating the market.” This state of play underscores the need for your agency to lean into its expertise, unique offerings, and personalized service that helps it stand out in the market.

A bank that understands insurance

As you navigate both the challenges and opportunities facing the insurance industry, Westfield Bank’s agency banking team understands what you’re going through and can provide valuable expertise, perspective, and guidance. Get in touch with us today.